LONDON – The average British person could pay off their mortgage ten years early if they abstained from alcohol and cigarettes, according to research from estate agents eMoov.

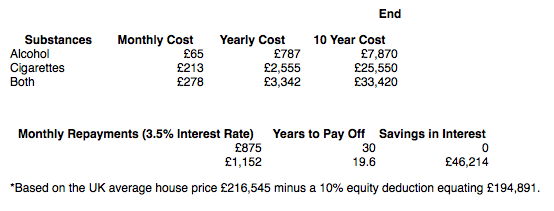

According to ONS and NHS data, the average person in the UK spends £787 a year on alcohol and £2,555 on cigarettes. Over the course of a decade, that amounts to £33,420.

The average house price in the UK is nearly £217,000, and assuming a 10% deposit payment, an average mortgage is around £195,000. At this price, a monthly mortgage would £875 on a 30-year repayment plan.

Eliminating alcohol and cigarette consumption would allow the average Brit to add £278 to that monthly payment, meaning that the typical mortgage could be paid back in 19 years and six months instead of 30 years.

Here’s what the figures look like:

Based on a typical mortgage interest rate of 3.5%, the move could also lead to a saving of £46,214 in interest payments.

Given that only 19% of UK adults smoke, the savings for smokers would be significantly higher than the annual average saving, and significantly lower for non-smokers.